$0.00

In stock

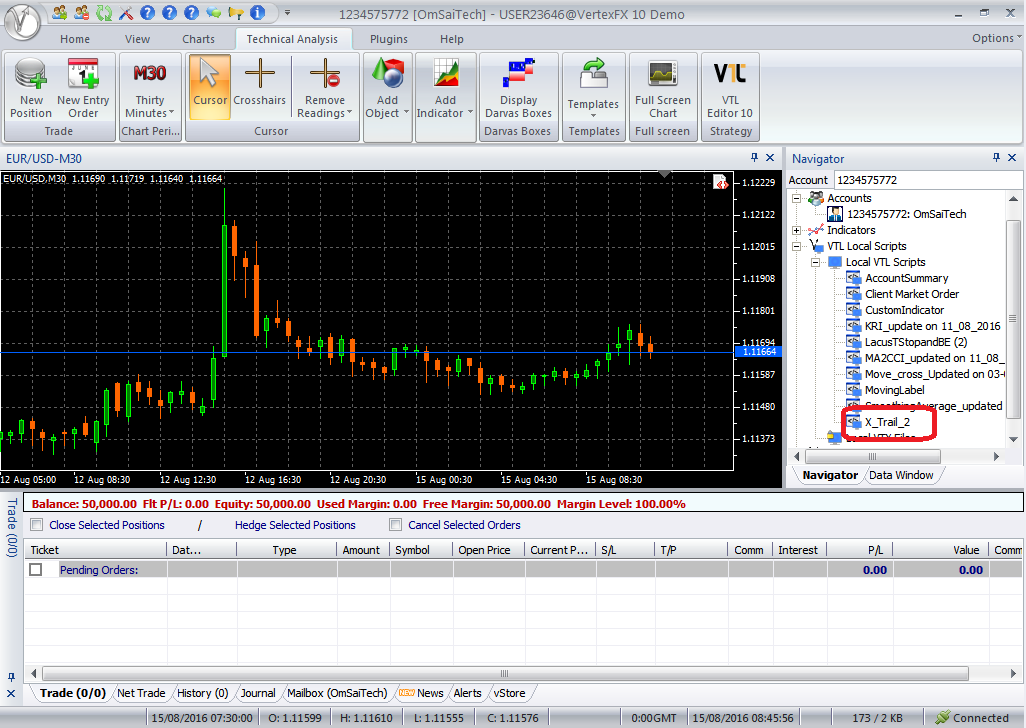

XTrail2 is a VertexFX client side VTL that scans trade conditions based on two Moving Averages, typically a fast Moving Average and a slow Moving Average. It only provides an ALERT message to the user, it DOES NOT open or close trades.

(Downloads - 1838)

XTrail2 is a VertexFX client side VTL that scans trade conditions based on two Moving Averages, typically a fast Moving Average and a slow Moving Average. It only provides an ALERT message to the user, it DOES NOT open or close trades.

The concept behind the XTrail2 script is that the combination of a fast Moving Average and a slow Moving Average identifies trending markets, especially fast breakouts. It scans for trading opportunities every RUN_INTERVAL seconds, and alerts the user when a Buy or a Sell criteria is met.

The fast Moving Average responds to price quicker than the slow Moving Average. When the market transitions from a sideways movement to a breakout (either bullish or bearish), the fast Moving Average crosses in the slow Moving Average in the direction of the breakout. If this cross is sustained on the next bar, a BULLISH or BEARISH criteria is confirmed and the script generates a BUY or SELL alert respectively.

Buy (Bullish) Alert – A Buy alert is generated when the fast Moving Average of current candle is above its slow Moving Average, and fast Moving Average of the previous candle is also above its slow Moving Average, and the fast Moving Average two candles ago is below its slow Moving Average of two candles ago.

In other words, the fast Moving Average has crossed above the slow Moving Average on the previous candle and is continuing its uptrend. This implies that the price has exhibited a bullish breakout recently, and is a potential for Buy trade.

Sell (Bearish) Alert – A Sell alert is generated when the fast Moving Average of the current candle is below its slow Moving Average, and the fast Moving Average of the previous candle is also belwo its slow Moving Average, and the fast Moving Average two candles ago is above its slow Moving Average of two candles ago.

In other words, the fast Moving Average has crossed below the slow Moving Average on the previous candle and is continuing its downtrend. This implies that the price has exhibited a bearish breakout recently, and is a potential for Sell trade.

Configurable Inputs

1. MA1_PERIOD – The period used to calculate the first Moving Average.

2. MA1_SHIFT – The value number of bars ago of the first Moving Average used in the calculations.

3. MA1_PRICE – The price field used to calculate the first Moving Average. The supported price fields are – Close = 0, Open = 1, High = 2, Low = 3, Median = 4, Typical = 5, Weighted = 6.

4. MA1_METHOD – The method used to calculate the first Moving Average. There are four supported methods for calculating the Moving average. These are – SMA = 0, EMA = 1, SMMA = 2 and LWMA = 3.

5. MA2_PERIOD – The period used to calculate the second Moving Average.

6. MA2_SHIFT – The value number of bars ago of the second Moving Average used in the calculations.

7. MA2_PRICE – The price field used to calculate the second Moving Average. The supported price fields are – Close = 0, Open = 1, High = 2, Low = 3, Median = 4, Typical = 5, Weighted = 6.

8. MA2_METHOD – The method used to calculate the second Moving Average. There are four supported methods for calculating the Moving average. These are – SMA = 0, EMA = 1, SMMA = 2 and LWMA = 3.

9. RUN_INTERVAL – The interval in seconds when the trade conditions are scanned. For example if this value is 10, then the trade conditions are checked every 10 seconds.

Usage

- Download the attachment from vStore or directly from the vStore tab in your terminal by performing a right click on it and selecting Download & Install

- Copy it to your company VertexFX Local VTL Files folder i.e. C:ProgramDataVertexFX Client Terminals”Company name”VTL10Local VTL Scripts

- Restart your Client Terminal or Right Click on “Local VTL Scripts” Tree Node to find the script.

Additional information

| Plugin-Type | Client VTL – Expert Advisor |

|---|---|

| Compatibility |