$0.00

In stock

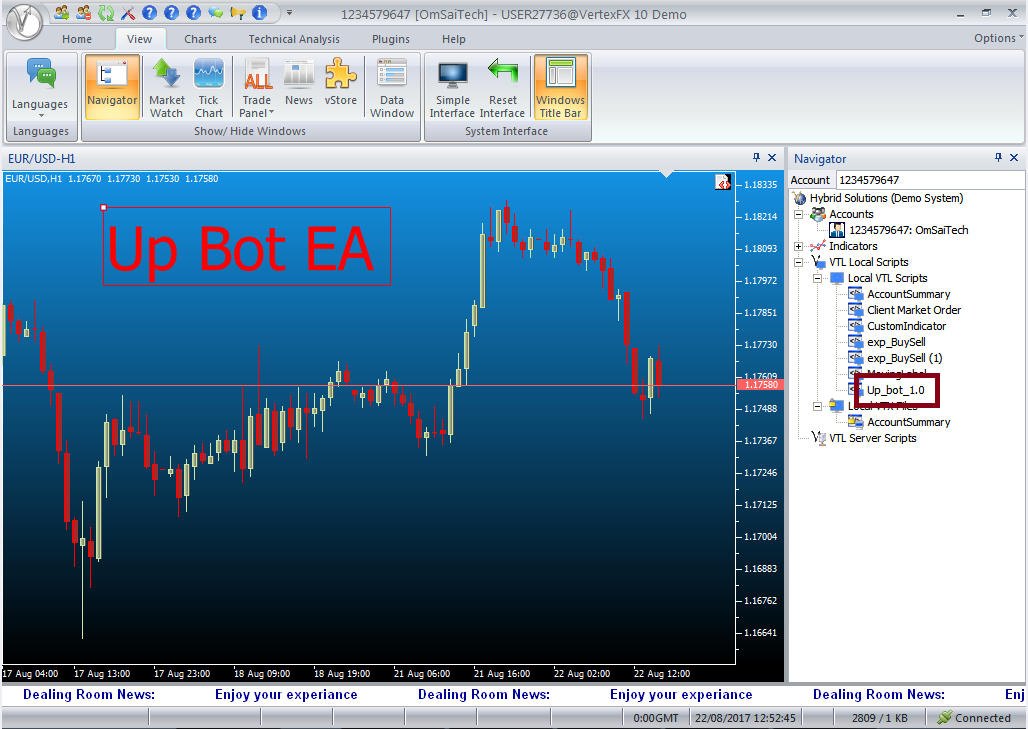

The Up Bot Expert Advisor is a powerful bi-directional Vertex-FX client-side script that trades based on price divergence between two consecutive bars.

(Downloads - 2046)

Up Bot Auto Trader is a powerful bidirectional VertexFX client-side script that trades based on price divergence between two consecutive bars.

The concept behind this trading system is based on the formation of two consecutive Highs (or Lows) in close proximity, followed by a reversal in the opposite direction. The likelihood of the price continuing the reversal towards a new High (or Low) is very high, and entering a trade under such circumstances can be very rewarding. This is called High-Low divergence. Robust money management techniques using a tight profit target, stop-loss and use of a trailing stop can enhance the profitability of the trades.

A BUY position is opened if the absolute distance between the current Low and the previous Low is less than the value of HLDivergence parameter, and the Bid price is at a distance between SpanPrice and 1.5 times the SpanPrice from the current Low. The idea behind this entry is that after two adjacent Lows are formed very close to each other, and as the price continues to rise, the probability of a bullish breakout is very high, and a BUY trade is thus opened. Only one BUY trade per candle is allowed.

A SELL position is opened if the absolute distance between the current High and the previous High is less than the value of the HLDivergence parameter, and the Ask price is at a distance between SpanPrice and 1.5 times the SpanPrice from the current High. The idea behind this entry is that after two adjacent Highs are formed very close to each other, and as the price continues to fall, the probability of a bearish breakout is very high and a SELL trade is thus opened. Only one SELL trade per candle is allowed.

Both BUY and SELL trades can co-exist at that the same time, and are tracked independently. The maximum number of open trades allowed is restricted by the MaxTrades parameter.

A trade can be closed either when the profit-target, stop-loss or trailing-stop loss is hit. Additionally, a trade can exit if OutputAtLowerand/or OutputAtReverseparameters at enabled and their conditions are met.

When OutputAtLower is enabled, BUY trade(s) are closed when the current Bid price is lower than the current candle Low, and SELL trades are closed when the Ask price is above the current candle High. This setting is useful in exiting trades that have false breakouts quickly. When a BUY trade is active, and the price starts falling and makes a new Low, it is likely that the market circumstances have changed and hence it is diligent to exit the BUY trade. Similarly, when a SELL trade is active, and the price starts rising and makes a new High, it is likely that the market circumstances have changed and hence it is diligent to exit the SELL trade.

Another safety mechanism for exiting open trades is the OutputAtReverse setting. When enabled, the Auto Trader does not wait for the OutputAtLower trigger, which occurs only when a new Low (or High) is made. For a BUY trade, it exits when the current Bid price is at a distance between SpanReverseand 1.5 times SpanReversefrom the current Low. Similarly, for a SELL trade, it exits when the current Ask price is at a distance between SpanReverse and 1.5 times SpanReverse from the current High.

The OutputAtReverse ensures that the trade exits quickly if there is a change in direction, but at the same time, in a sideways market, it can generate false exits.The value of SpanToReverse should always be less than the value of SpanPrice.

Configurable Inputs

1.TakeProfit – The profit target of each individual trade in pips.

2.StopLoss – The stop-loss of each individual trade in pips.

3.HLDivergence – The maximum allowed distance in pips between two consecutive Highs, or Lows for a High-Low divergence to occur.

4.SpanPrice – The maximum distance between the current High and Bid, or current Low and Ask for identifying trade entries and exits.

5.Lots – The lot-size of each trade.

6.MaxTrades – The maximum number of open trades allowed at a given time.

7.Slippage –The maximum allowed slippage in pips.

8.TrailingStop –Specifies whether the trailing stop feature is enabled.

9.TrailingStopLoss –The trailing stop loss distance in pips when the trailing stop feature is enabled.

10.ZeroTrailingStop –If this feature is enabled then the trailing stop is applied immediately, and does not wait for the trade to be profitable.

11.StepTrailing –The trailing step distance in pips. The trailing stop increments by this distance in a ladder-style method.

12.OutputAtLower –If this feature is enabled, then all BUY positions are closed when the price crosses below the Low of the previous candle, and all SELL positions are closed when the price crosses above the High of the previous candle.

13.OutputAtReverse –Specifies whether to close open positions when the price reverses after a failed High-Low Divergence.

14.SpanToReverse –Specifies the distance in pips to close open positions when the price reverses from the current High or Low. If OutputAtReverse is enabled, and a failed High-Low divergence is detected, then the BUY position is closed when the price is at distance of SpanToReverse pips from the current High. Likewise, a SELL position is closed when the price is at a distance of SpanToReverse pips from the current Low.

Usage

- Download the attachment from vStore or directly from the vStore tab in your terminal by performing a right click on it and selecting Download & Install

- Copy it to your company VertexFX Local VTL Files folder i.e. C:ProgramDataVertexFX Client Terminals”Company name”VTL10Local VTL Scripts

- Restart your Client Terminal or Right Click on “Local VTL Scripts” Tree Node to find the script.

Additional information

| Plugin-Type | Client VTL – Expert Advisor |

|---|---|

| Compatibility |