$0.00

In stock

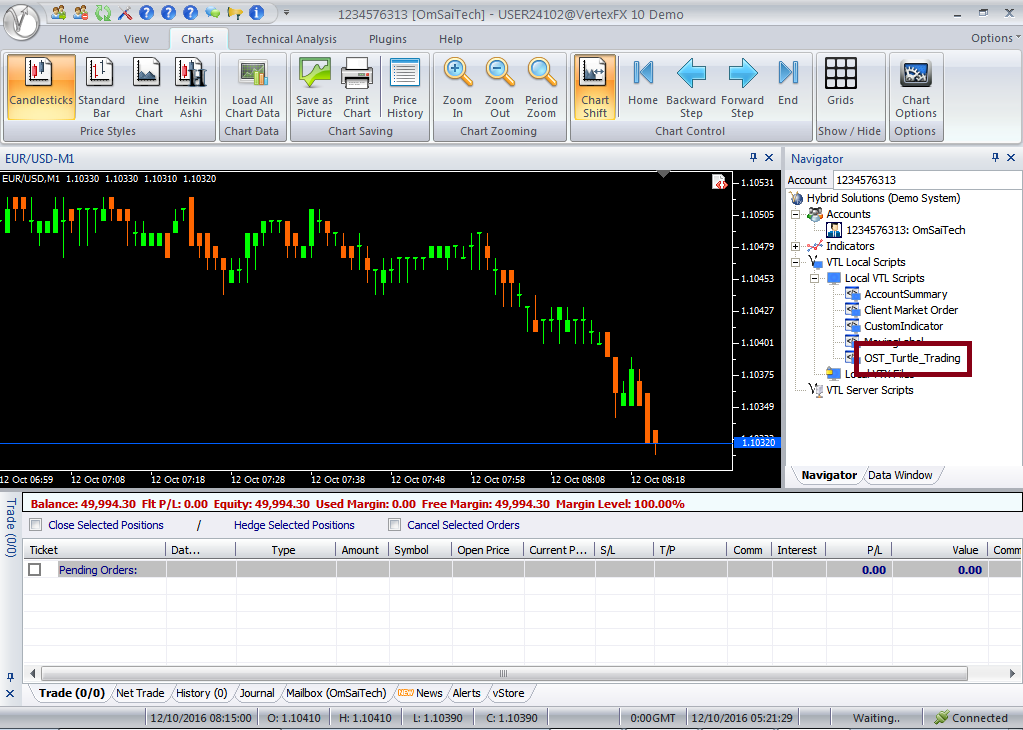

The OST Turtle Trading Expert Advisor is a VertexFX client-side script that trades market breakouts. It is an enhancement of the popular Turtle Trading strategy.

This Expert Advisor identifies the Highest High and the Lowest Low of the recent TRADING_PERIOD candles to place LONG and SHORT breakout trades respectively. When the price breaks out of its recent trading bandit implies a new market direction is in force, and therefore the Expert Advisor places a trade in the direction of the trade.

(Downloads - 1814)

The OST Turtle Trading Expert Advisor is a VertexFX client-side script that trades market breakouts. It is an enhancement of the popular Turtle Trading strategy.

This Expert Advisor identifies the Highest High and the Lowest Low of the recent TRADING_PERIOD candles to place LONG and SHORT breakout trades respectively. When the price breaks out of its recent trading bandit implies a new market direction is in force, and therefore the Expert Advisor places a trade in the direction of the trade.

When the Expert Advisor is started, it calculates the Highest High and the Lowest Low of the recent TRADING_PERIOD candles for the previous candle. When the price crosses above this Highest High value, a BUY (LONG) trade is opened if a BUY trade does not already exist. If a SELL trade exists when a BUY signal is received, the Expert Advisor keeps the SELL trade open and opens a new BUY trade.

On the contrary if the price crosses below the Lowest Low value, a SELL (SHORT) trade is opened if a SELL trade does not already exists. If a BUY trade already exists when a SELL signal is received, the Expert Advisor keeps the BUY trade open and opens a new SELL trade.

The lot-size is based upon the MONEY_MANAGEMENT setting. If MONEY_MANAGEMNT is set to false, the lot-size is set to the fixed LOT_SIZE value. However, if the setting is true, the lot-size is calculated based on the RISK_PERCENT and the initial stop-loss.

This Expert Advisor employs two levels of stop-loss – an initial stop-loss that is based on the Highest High and Lowest Low of the recent STOP_PERIOD candles, and a dynamic stop-loss based on the Average True Range (ATR).

The initial stop-loss is the Lowest Low of the recent STOP_PERIOD for BUY trades, and the Highest High of the recent STOP_PERIOD for SELL trades. These levels also act as trailing stop.

If SL_ENABLED is set to true, the Expert Advisor employs a trailing stop using the Average True. The trailing stop trails the current price by Average True Range multiplied by the ATR_MULTIPLIER value.

Configurable Inputs

1.SHIFT – The number of candles from the latest candle based on which the trading levels are calculated. For example, if this value is 1, the Expert Advisor calculates the trading levels based on the previous candle. If this value is 0, then the Expert Advisor calculates the trading levels based on the current candle.

2.TRADING_PERIOD – The number of candles over which the Highest High and Lowest Low values are calculated for the trading signals. For example, if this value is 40, then the Expert Advisor calculates the Highest High and the Lowest Low over the recent 40 candles.

3.STOP_PERIOD– The number of candles over which the Highest High and Lowest Low values are calculated for the exit (stop-loss) signals. For example, if this value is 20, then the Expert Advisor calculates the Highest High and the Lowest Low over the recent 20 candles – which is then used as the stop-loss levels.

4.SL_ENABLED– Specifies whether Average True Range (ATR) based stop-loss is enabled.

5.ATR_PERIOD– The number of candles over which the Average True Range (ATR) is calculated for stop-loss purpose.

6.ATR_MULTIPLIER – The multiplier applied to the Average True Range (ATR) to derive the stop-loss value.

7.MONEY_MANAGEMENT – Specifies whether the lot-size should be calculated based upon the Account Balance and the risk. If this value is false, the lot-size is fixed and based upon the LOT_SIZE parameter.

8.RISK_PERCENT – The maximum risk per trade allowed in percentage for each trade. If MONEY_MANAGEMENT is enabled the lot-size is calculated based upon the maximum loss that will be incurred if the stop-loss is hit. For example, if this value is 2 (%) and the Account Balance is $1000, then the maximum risk per trade allowed is $20.

9.LOT_SIZE – The fixed lot-size to be used if MONEY_MANAGEMENT is set to false.

10.SLIPPAGE– The maximum slippage in points that is allowed for opening market orders. If this value is 0, then the slippage criteria is ignored.

Usage

- Download the attachment from vStore or directly from the vStore tab in your terminal by performing a right click on it and selecting Download & Install

- Copy it to your company VertexFX Local VTL Files folder i.e. C:ProgramDataVertexFX Client Terminals”Company name”VTL10Local VTL Scripts

- Restart your Client Terminal or Right Click on “Local VTL Scripts” Tree Node to find the script.

Additional information

| Plugin-Type | Client VTL – Expert Advisor |

|---|---|

| Compatibility |