$0.00

In stock

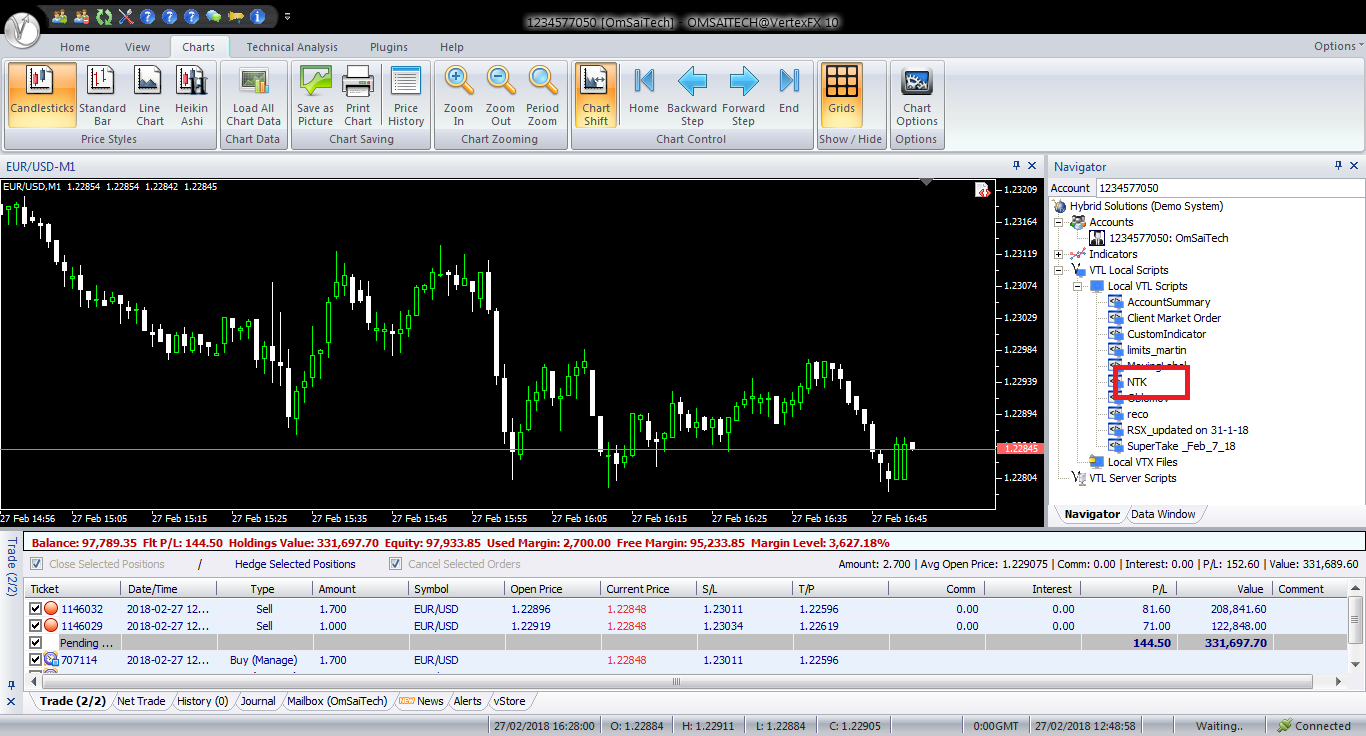

NTK Auto Trader is a client-side script builtupon price breakout technique. It is based on the idea that when a strong trend starts, the probability of this strong trend continuing is very high. Hence, trades opened in the direction of the trend have a greater probability of success and profit. This Auto Trader capitalizes on this idea by trading in the direction of the breakout. It does not attempt to determine the direction of the breakout, but rather waits to trade in the breakout direction by placing pending orders in both directions.

(Downloads - 1489)

NTK Auto Trader is a client-side script builtupon price breakout technique. It is based on the idea that when a strong trend starts, the probability of this strong trend continuing is very high. Hence, trades opened in the direction of the trend have a greater probability of success and profit. This Auto Trader capitalizes on this idea by trading in the direction of the breakout. It does not attempt to determine the direction of the breakout, but rather waits to trade in the breakout direction by placing pending orders in both directions.

When the Auto Trader starts, it places a BUY-STOP and a SELL-STOP order based on the NET_START, PER and CENTER parameters. If PER is set to 0, then the initial pending STOP orders are placed at a distance of NET_START points from the current price. However, if the value of PER is greater than 0, then it first finds the Highest High and the Lowest Low of the recent PER candles. If CENTER is set to 0, then the initial BUY-STOP order is placed at a distance of NET_STEP points above the Highest High, and likewise the SELL-STOP order is placed at a distance of NET_STEP points below the Lowest Low. However, if CENTER is set to 1, then the BUY-STOP order is placed NET_STEP points above the mid-point of the Highest High and Lowest Low, and similarly the SELL-STOP order is placed NET_STEP points below the mid-point.One of these three modes of initial order placement is used based on the market conditions and the type of instrument being traded.

The take-profit specified by the TP parameter is typically greater than twice the stop-loss defined by the SL parameter. This ensures a greater Profit Factor and results in higher overall profitability. The initial lot-size is calculated based on the SL, PERCENT and Account Balance.

After the initial STOP orders are placed, the Auto Trader waits for a breakout in either direction. Once a pending order is triggered, the opposite pending order is deleted. Thus the Auto Trader trades only in the direction of the trend. It does not open orders in the counter-trend direction.

Once a trade is open, the Auto Trader employs a trailing stop – either using a fixed distance as specified by TRAIL_PROFIT or based on the Simple Moving Average based on USE_MA and MOVING_PERIOD. Similarly, if BE_ZUB is specified, then the trailing stop is moved to the entry price once the trade reaches a profit of BE_ZUB points.

The next pending order is placed in the same direction after the initial trade is opened. For example, if the initial trade is a BUY trade, then a new BUY-STOP order is placed at distance of NET_STEPpoints from this initial trade. The lot-size of the second order is MUL times the lot-size of the first order. This process is repeated till the MAX_TRADES number of trades is reached. Once this limit is reached, the Auto Trader does not place new trades, and only manages the existing trades. Each position is closed either at the take-profit, or at the initial stop-loss, break-even stop or by the trailing stop. Finally, once the last trade is closed, the Auto Trader starts over again by placing the initial BUY-STOP and SELL-STOP orders.

In the adverse scenario of the market changing its direction, the trades are exited at stop-loss. Typically, the stop-loss is half (or less) the value of the take-profit, so a smaller Win/Loss Ratio is sufficient to generate a superior Profit Factor.

Configurable Inputs

1.NET_STEP – The distance in points from the current price or the previous order price at which the pending orders are placed. For example, if this value is set to 100, then the initial BUY-STOP and SELL-STOP orders are placed at a distance of 100 points from the current price.

2. SL – The stop-loss of each individual trade in points.

3. TP –The take-profit of each individual trade in points.

4. MUL–The lot-size multiplier to calculate the maximum allowed lot-size if money management method is set to ADVANCED.

5. TRAIL_PROFIT– The trailing stop in points applied to each individual trade.

6. MM – The money management method to be applied. The two supported methods are BASIC (1) and ENHANCED (2). When BASIC money management is employed, the lot-size is calculated based upon the Account Balance, and the lot-size PERCENT. If ENHANCED money management is employed, the largest allowed lot size is calculated based on the initial lot-size, multiplier MUL and maximum allowed trades MAX_TRADES.

7. MAX_TRADES –The maximum number of open trades allowed.

8. PERCENT –The maximum risk of the Account Balance used to calculate the initial lot size. For example, if this value is set to 5, then the lot-size is calculated based on the stop-loss SL, with a maximum possible loss of 5% of the Account Balance if the stop-loss were to be hit.

9. MIN_SUM –The minimum amount of free margin in base currency that must be available for the Auto Trader to trade. If the account free margin is less than this value, the Auto Trader stops trading.

10. BE_ZUB –Specifies whether break-even stop-loss should be applied. If value is set to 1, then the break-even stop is set to trade entry price when the trade profit of DELTA_LAST points is reached.

11. DELTA_LAST –The profit in points that must be reached to set the break-even stop to the entry price. It is applicable only if BE_ZUB is set to 1.

12. USE_MA –Specifies whether Auto Trader should use the trailing stop based upon the direction of the Moving Average. If set to 1, then the trailing stop is calculated based on the Simple Moving Average.

13. MOVING_PERIOD –The period used to calculate the Simple Moving Average.

14. MOVING_SHIFT –Specifies the number of candles ago whose Simple Moving Average will be referenced if USE_MA is set to 1. For example if this value is set to 0, the Auto Trader uses the Simple Moving Average of the current candle.

15. PER –Specifies the number of candles to look back to calculate the entry price of the initial trades. For example, if PER is set to 5, then the initial BUY-STOP order is placed NET_STEP points above the Highest High of the recent 5 bars, and the initial SELL-STOP order is placed NET_STEP points below the Lowest Low of the recent 5 bars. If PER is set to 0, then the initial BUY-STOP and SELL-STOP orders are placed at the distance of NET_STEP points from the current price.

16. CENTER – Specifies the method to calculate the initial trading range in conjunction with the PER parameter. If the value of CENTER is set to 0, then the initial trades are placed at a distance of NET_STEP points from the Highest High and Lowest Low of the recent PER candles. If the value of CENTER is set to 1, then the initial trades are placed at a distance of NET_STEP points from the mid-point Highest High and Lowest Low range. If the value of PER is set to 0, then this parameter is ignored.

Usage

- Download the attachment from vStore or directly from the vStore tab in your terminal by performing a right click on it and selecting Download & Install

- Copy it to your company VertexFX Local VTL Files folder i.e.C:Users”Username”AppDataRoamingVertexFX Client Terminals“Company name”VTL10Local VTL Scripts

- Restart your Client Terminal or Right Click on “Local VTL Scripts” Tree Node to find the script.

Additional information

| Plugin-Type | Client VTL – Expert Advisor |

|---|---|

| Compatibility |