$0.00

In stock

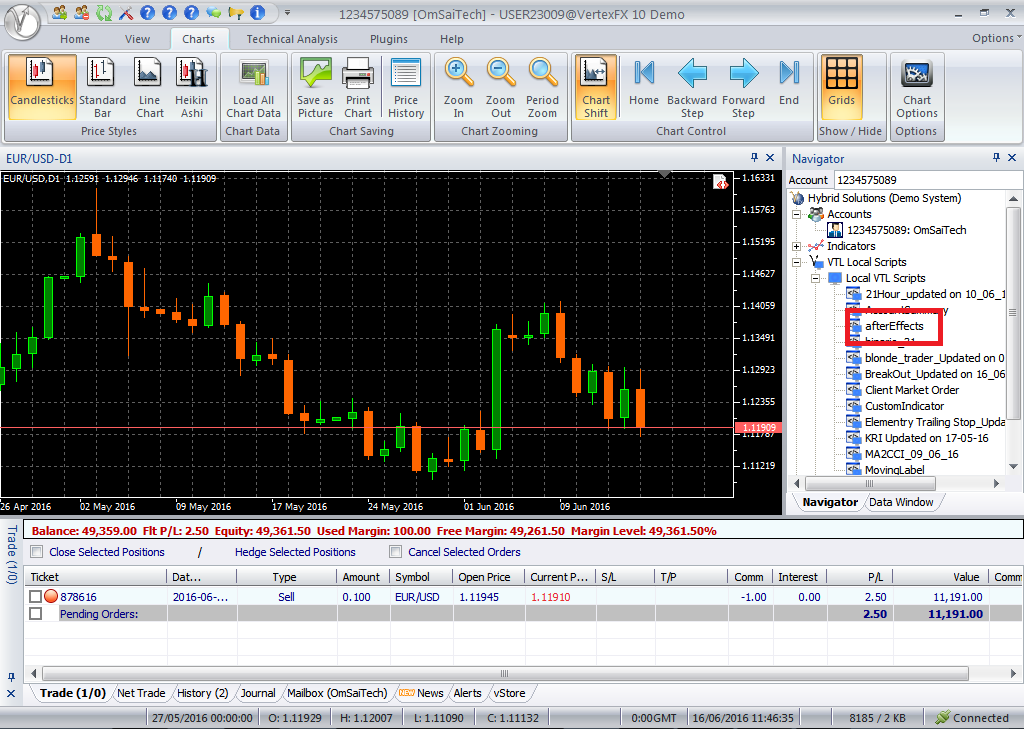

AfterEffects is an innovative VertexFX client-side Auto Trader script that trades based on trend and breakout in market direction. The idea behind this Auto Trader is trade in the direction of the breakout, with a predefined stop-loss to protect the trade in case of adversity.

(Downloads - 1878)

AfterEffects is an innovative VertexFX client-side Auto Trader script that trades based on trend and breakout in market direction. The idea behind this Auto Trader is trade in the direction of the breakout, with a predefined stop-loss to protect the trade in case of adversity.

When opposite signals are received, the trade is protected using break-even stop-loss and by opening hedged trade in the opposite direction. If the sum of the current Close and Open of 2P bars ago is greater than twice the Open price of P bars ago, a BUY signal is generated, otherwise a SELL signal is generated. If the RANDOM input variable is set to FALSE then the signals are reversed – and BUY signal is reversed to SELL and SELL signal is reversed to BUY. So, its BUY if current Close price Plus Open price at 2P bars ago is greater than Double of Close price at P bars ago SELL if, current Close Price Plus Open price at 2P bars ago is less than Double of Close price at P bars ago the market signals are evaluated on close of each candle. If a new signal is encountered, the trade is placed accordingly.

After placing new trades (if any) as per the signal criteria, it evaluates open positions for updating the stop-loss, targets and hedging mechanism. The following rules are applied to open positions:

1.If a BUY position is open, and the current signal is SELL, and the open profit is greater than twice the SL (stop-loss), a hedged SELL position is opened with a lot-size equal to twice the lot-size of the BUY position.

2.If a BUY position is open, and the current signal is SELL, and the trade is in profit but less than twice the SL (stop-loss), then the stop-loss is moved to the entry price of the trade, thus protecting the trade.

3.If a SELL position is open, and the current signal is BUY, and the open profit is greater than twice the SL (stop-loss), a hedged BUY position is opened with a lot-size equal to twice the lot-size of the SELL position.

4.If a SELL position is open, and the current signal is BUY, and the trade is in profit but less than twice the SL (stop-loss), then the stop-loss is moved to the entry price of the trade, thus protecting the trade.

Configurable Parameters

1. SL – The stop-loss value of each trade in points.

2. P – The number of bars to look back to identify trading rules.

3. RANDOM – Specifies whether to use random price ranges. If TRUE, then random price ranges are used for trades. If FALSE, then actual (prices derived from charts) are used for trades.

4. LOTS – The lot size of each trade opened by the Auto Trader.

Usage

- Download the attachment from vStore or directly from the vStore tab in your terminal by performing a right click on it and selecting Download & Install

- Copy it to your company VertexFX Local VTL Files folder i.e. C:ProgramDataVertexFX Client Terminals”Company name”VTL10Local VTL Scripts

- Restart your Client Terminal or Right Click on “Local VTL Scripts” Tree Node to find the script.

Additional information

| Plugin-Type | Client VTL – Expert Advisor |

|---|---|

| Compatibility |