$0.00

In stock

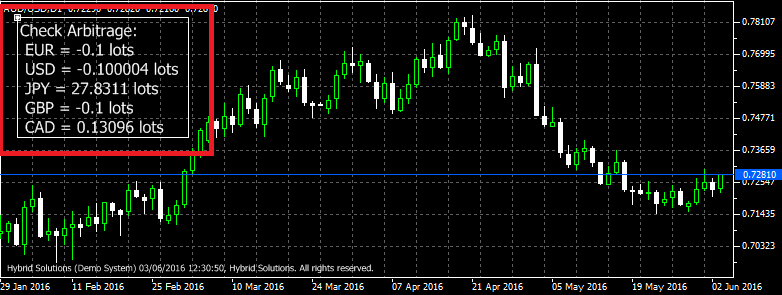

CheckArbitrage is an innovative and powerful VertexFX client-side indicator that tracks all open positions in the current trading account and evaluates the net position and the net arbitrage value of these open positions.

In the first step, it evaluates through all the open positions. For each open position, the long component of the instrument’s volume is multiplied by its opening price and added to the specific currency pair. Similarly, the short component of the instrument’s volume is multiplied by its opening price and subtracted from the specific currency pair

(Downloads - 1859)

CheckArbitrage is an innovative and powerful VertexFX client-side VTL indicator that tracks all open positions in the current trading account and evaluates the net position and the net arbitrage value of these open positions.

In the first step, it evaluates through all the open positions. For each open position, the long component of the instrument’s volume is multiplied by its opening price and added to the specific currency pair. Similarly, the short component of the instrument’s volume is multiplied by its opening price and subtracted from the specific currency pair.

For example, consider that we are LONG 0.1 lots of EUR/USD at 1.1000, and SHORT 0.2 lots of GBP/USD at 1.4000.

In the first case of EUR/USD, the long component is EUR and the short component is USD. So, the indicator multiplies 0.1 x 1.1100 and stores it under EUR component. Similarly, it multiplies 0.1 x 1.1100 and stores it (subtracts) under the USD component. We now have the following values

EUR: 0.1 x 1.1100

USD: -0.1 x 1.1100

It now proceeds to evaluate the next position, which is SHORT 0.2 lots of GBP/USD at 1.4000. In this case, the short component is GBP, and the LONG component is USD.

We now add the LONG component, which is 0.2 x 1.4000 USD to the cumulative USD value, and the SHORT component, which is 0.2 x 1.4000 GBP to the cumulative GBP value. Since there is no previous cumulative GBP value, this is the first entry for GBP.

So, the cumulative values are:

EUR: 0.1 x 1.1000 (from trade #1)

USD: -0.1 x 1.1100 (from trade #1) + 0.2 x 1.4000 (from trade #2)

GBP: -0.2 x 1.4000 (from trade #2)

The indicator provides the net cumulative position for each currency, thereby giving the user a holistic view of his/her positions. The user can identify the bias of the current account. For example, if the net cumulative position of EUR is positive, and of GBP and USD is negative, it implies that the user is bullish on EUR and bearish on GBP and USD. Therefore a bearish movement in EUR, or a bullish movement in GBP or USD is detrimental to the user’s account. Using this CheckArbitrage indicator, the user can protect the account accordingly.

This indicator script does not open or close orders. This indicator tracks pairs of the following currencies – AUD, CAD, CHF, CZK, DKK, EUR, GBP, HKD, JPY, MXN, NOK, NZD, PLN, RUR, SEK, TRY, USD and ZAR.

Usage

- Download the attachment from vStore or directly from the vStore tab in your terminal by performing a right click on it and selecting Download & Install

- Copy it to your company VertexFX Local VTL Files folder i.e. C:ProgramDataVertexFX Client Terminals”Company name”VTL10Local VTL Scripts

- Restart your Client Terminal or Right Click on “Local VTL Scripts” Tree Node to find the script.

Additional information

| Plugin-Type | Client VTL – Custom Indicator |

|---|---|

| Compatibility |