$0.00

In stock

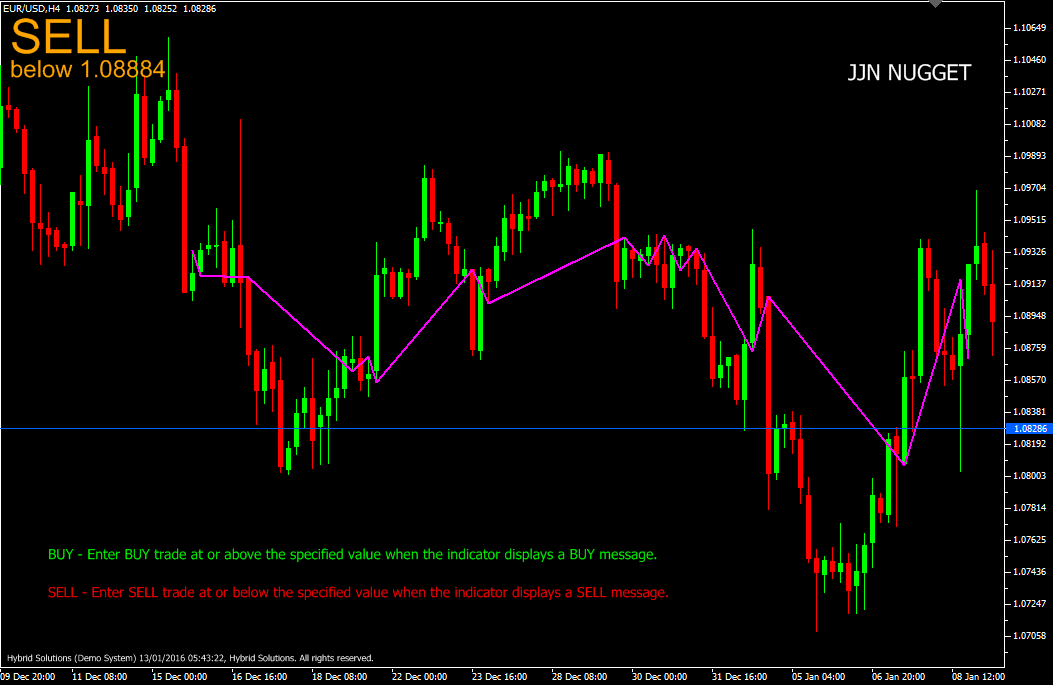

JJN Nugget is a powerful VertexFX client side VTL indicator that gives precise entry and exit levels and signals based on Swing trading breakouts. It is based upon 8 moving averages and Swing Highs and Swing Lows. At first step we calculate the Exponential Moving Average (EMA) for 5, 8, 13, 21, 34, 55, 89 and 144 bars. These are Fibonacci periods, each period the fibonacci series from its previous period.

(Downloads - 1571)

JJN Nugget is a powerful VertexFX client side VTL indicator that gives precise entry and exit levels and signals based on Swing trading breakouts. It is based upon 8 moving averages and Swing Highs and Swing Lows. At first step we calculate the Exponential Moving Average (EMA) for 5, 8, 13, 21, 34, 55, 89 and 144 bars. These are Fibonacci periods, each period the fibonacci series from its previous period.

In next step we calculate the sum of these eight Exponential Moving Averages, and then the average of the sum. A buy signal is generated if the current median price (average of current High and Low) closes above the average EMA. Similarly a Sell signal is generated if the current median price (average of current High and Low) closes below the average EMA. The concept behind this indicator is that the EMA of the Fibonacci periods forms a natural price level. When this price level is breached, there is a high probability of breakout in the direction of the break.

Buy: Place Buy position at or above the specified value when the indicator displays a Buy message. Do not open Buy trade if candle has gap-up opening, or has a long bullish candle body above the entry price. In such a scenario wait for a retracement. Place stop-loss at the nearest Swing Low below the suggested Buy level.

Sell: Place Sell position at or below the specified value when the indicator displays a Sell message. Do not open Sell trade if candle has gap-down opening, or has a long bearish candle body below the suggested Sell level. In such a scenario wait for a bounce-back (rise). Place stop-loss at the nearest Swing High above the suggested Sell level.

Usage

- Download the attachment from vStore or directly from the vStore tab in your terminal by performing a right click on it and selecting Download & Install

- Copy it to your company VertexFX Local VTL Files folder i.e. C:ProgramDataVertexFX Client Terminals”Company name”VTL10Local VTL Scripts

- Restart your Client Terminal or Right Click on “Local VTL Scripts” Tree Node to find the script.

Additional information

| Plugin-Type | Client VTL – Custom Indicator |

|---|---|

| Compatibility |