$0.00

In stock

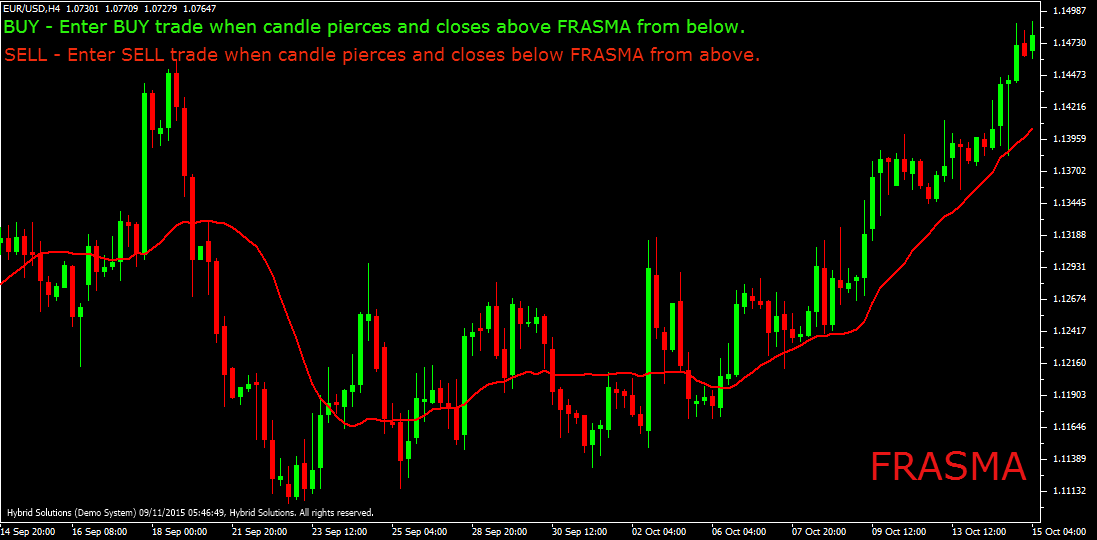

FRASMA (Fractally Modified Simple Moving Average) is a powerful VertexFX client side VTL indicator that provides trend-following entries and exits.

FRASMA is derived from the family of moving averages, by calculating the fractal points and weighting them according to their precedence. At first we calculate the highest and lowest price values over the recent PERIOD bars. In the next step, we calculate the linear weighted Stochastics from the highest and lowest price values derived in the first step. In the third step we calculate the normalized logarithm of the value derived in the previous step. Finally, the FRASMA value is calculated by computing the average of the value derived in the previous step.

(Downloads - 1513)

FRASMA (Fractally Modified Simple Moving Average) is a powerful VertexFX client side VTL indicator that provides trend-following entries and exits.

FRASMA is derived from the family of moving averages, by calculating the fractal points and weighting them according to their precedence. At first we calculate the highest and lowest price values over the recent PERIOD bars. In the next step, we calculate the linear weighted Stochastics from the highest and lowest price values derived in the first step. In the third step we calculate the normalized logarithm of the value derived in the previous step. Finally, the FRASMA value is calculated by computing the average of the value derived in the previous step.

The concept behind FRASMA is that the price structure exhibits key fractal points, which are highest and lowest points in the specified range. These points provide clues to the market direction and trend. In a strong uptrend, when the upper fractal point is broken, it signals the continuation of an uptrend, whereas if the lower fractal point is broken, it marks the continuation of the downtrend. By normalizing these fractal points into a Moving Average helps us eliminate the lag and clearly mark the price trend.

|

BUY :

|

Place Buy position when candle prices closes above FRASMA from below. Do not open trade if candle gaps up above the FRASMA.

|

|---|---|

|

SELL :

|

Place Sell trade when candle prices closes below FRASMA from above. Do not open trade if candle gaps down below the FRASMA.

|

Usage

- Download the attachment from vStore or directly from the vStore tab in your terminal by performing a right click on it and selecting Download & Install

- Copy it to your company VertexFX Local VTL Files folder i.e. C:Program FilesCompany Namevtl10Local VTL Files

- Restart your Client Terminal or Right Click on “Local VTL Scripts” Tree Node to find the script.

Additional information

| Plugin-Type | Client VTL – Custom Indicator |

|---|---|

| Compatibility |