$0.00

In stock

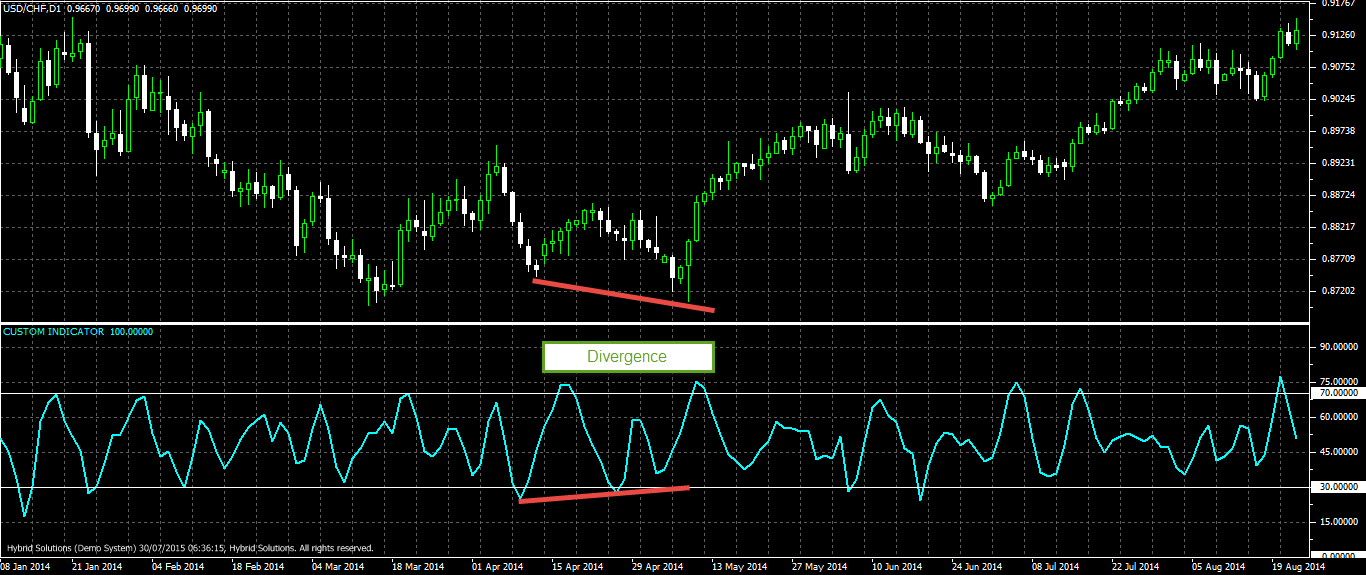

The Dynamo Stochastic is similar to Stochastic Oscillator, but it is a little more sensitive. It can be used for divergence trading like the stochastic oscillator. Oscillator values above 70 indicates overbought markets and price move is likely to loss momentum when oscillator breaks above 70. Oscillator below the 30 level indicates oversold market condition.

(Downloads - 1574)

The Dynamo Stochastic is similar to Stochastic Oscillator, but it is a little more sensitive. It can be used for divergence trading like the stochastic oscillator. Oscillator values above 70 indicates overbought markets and price move is likely to loss momentum when oscillator breaks above 70. Oscillator below the 30 level indicates oversold market condition.

The Dynamo Stochastic can be customized through the parameters. The parameters available are k period, d period and smoothing. To change parameters double click on the indicator name in navigator. This will open the script in VTL editor. The parameters are, located at the top of the script. It is properly commented for ease of use. “dPeriod” is the dynamo stochastic %D period, “kPeriod” is %K period and “smoothing” is the smoothing average period.

The indicator label with last bars Dynamo Stochastic level, displayed on chart can be dragged to any place on chart. The Dynamo stochastic can be used like the Stochastic Oscillator. It can identify Oversold, Overbought market conditions. Divergence between price and the oscillator is a good indication of short term trend reversal.

Additional information

| Plugin-Type | Client VTL – Custom Indicator |

|---|---|

| Compatibility |