$0.00

In stock

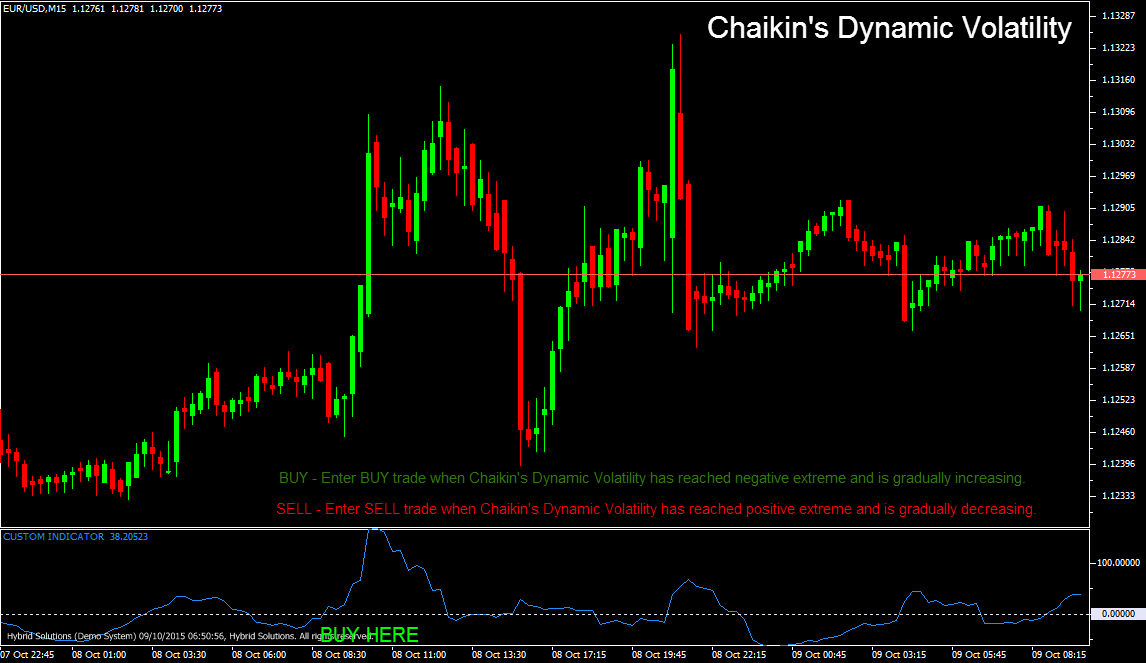

Chaikin’s Dynamic Volatility is a powerful VertexFX client side indicator used to determine markets retreat levels from new highs, or markets bouncing levels from new lows.

Chaikin’s Dynamic Volatility indicator shows when the market enters a trading range. When Chaikin’s Dynamic Volatility peaks out, we have reached a reversal point in the trend, and we can place counter trend position.

(Downloads - 1462)

Chaikin’s Dynamic Volatility is a powerful VertexFX client side indicator used to determine markets retreat levels from new highs, or markets bouncing levels from new lows.

Chaikin’s Dynamic Volatility indicator shows when the market enters a trading range. When Chaikin’s Dynamic Volatility peaks out, we have reached a reversal point in the trend, and we can place counter trend position. To calculate Chaikin’s Dynamic Volatility, we first calculate the difference between the candles high and low. This value is then averaged using an Exponential Moving Average (EMA) over the last MA_PERIOD candles. The Chaikin’s Dynamic Volatility is then calculated as the difference between the current average range and the average range I_PERIOD candles ago, divided by the average range I_PERIOD candles ago. It is multiplied by 100 and expressed on a scale of 100.

BUY – Place Buy position when Chaikin’s Dynamic Volatility has reached negative extreme and is gradually increasing.

SELL – Place Sell position when Chaikin’s Dynamic Volatility has reached positive extreme and is gradually decreasing.

Usage

- Download the attachment from vStore or directly from the vStore tab in your terminal by performing a right click on it and selecting Download & Install

- Copy it to your company VertexFX Local VTL Files folder i.e. C:Program FilesCompany Namevtl10Local VTL Files

- Restart your Client Terminal or Right Click on “Local VTL Scripts” Tree Node to find the script.

Additional information

| Plugin-Type | Client VTL – Custom Indicator |

|---|---|

| Compatibility |