$0.00

In stock

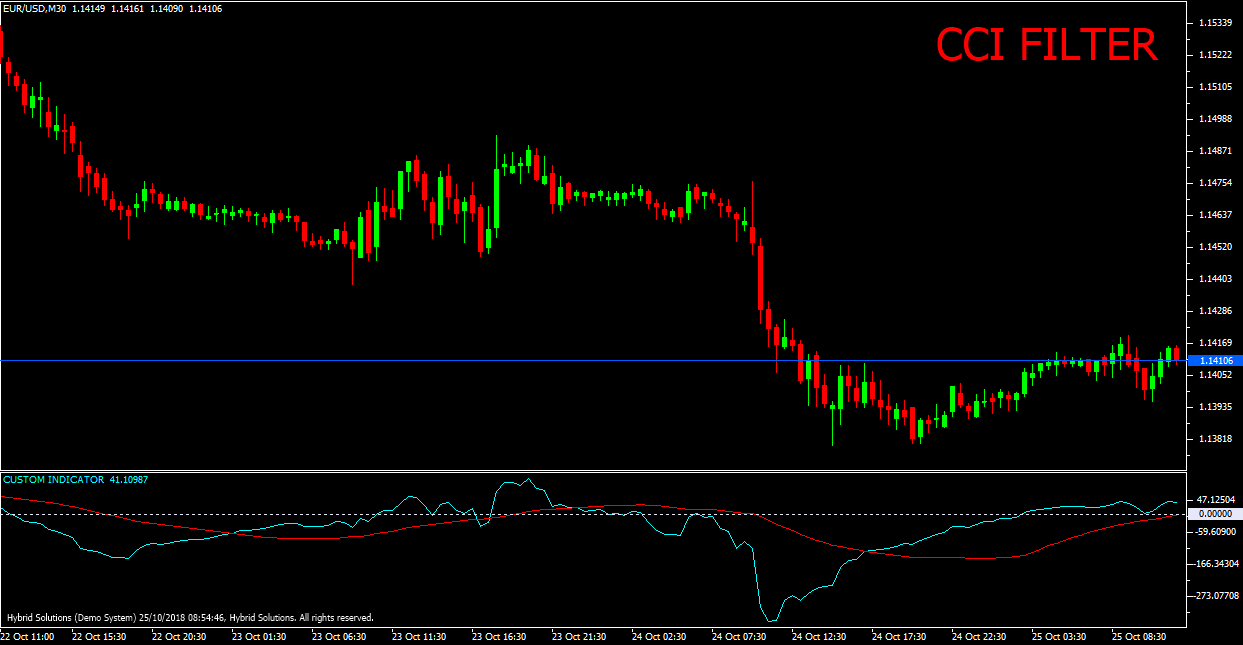

CCI Filter indicator is VertexFX client-side indicator script based on the Commodity Channel Index -CCI and Moving Average methods.

(Downloads - 1601)

CCI Filter indicator is VertexFX client-side indicator script based on the Commodity Channel Index -CCI and Moving Average methods.

The Commodity Channel Index (CCI) is a powerful indicator that provides important information on the trend. It is cyclical in nature and follows price closely. When the CCI has bottomed out below zero and is rising gradually, it implies that the market is rising and bullish. On the contrary, when the CCI has peaked and is falling gradually, it implies that the market is falling and bearish in nature. This is combined with the Moving Average of the Commodity Channel Index (CCI) which provides crossover signals.

To calculate the CCI_Filter indicator, we first calculate the Commodity Channel Index (CCI) over the recent CCI_PERIOD bars. The CCI PRICE specifies the price field to be used to calculate the CCI indicator. This is the BLUE component of the indicator.

In the next step, we calculate the Moving Average of the CCI over the recent MA_PERIOD bars. The method used to calculate the Moving Average is specified by the MA_METHOD parameter. This is the RED component of the indicator.

The RED component is used as the filter of the BLUE CCI component to provide the BUY and SELL signals.

BUY – Place BUY trade when the BLUE indicator component has crossed above the RED indicator component below the zero level at the close of the candle. Do not open the BUY trade if the candle has a gap-up opening. Place stop-loss below the nearest Swing Low or Support level.

SELL – Place SELL trade when the BLUE indicator component has crossed below the RED indicator component above the zero level at the close of the candle. Do not open the SELL trade if the candle has a gap-down opening. Place stop-loss above the nearest Swing High or Resistance level.

INPUTS :

1) CCI_PERIOD – The period over which the CCI values are calculated.

2) CCI_PRICE – The price field used to calculate the CCI. The permissible values are, 0 = Close, 1 = Open, 2 = High, 3 = Low, 4 = Median, 5 = Typical and 6 = Weighted.

3) MA_PERIOD – The period over which the Moving Average (of the CCI) is calculated.

4) MA_METHOD – The method for calculating Moving Average. The supported values are Simple Moving Average (0), Exponential Moving Average (1), Smoothed Moving Average (2), Linear Weighted Moving Average (3) and Least Squares Moving Average (4).

Usage

- Download the attachment from vStore or directly from the vStore tab in your terminal by performing a right click on it and selecting Download & Install

- Copy it to your company VertexFX Local VTL Files folder i.e.C:Users”Username”AppDataRoamingVertexFX Client Terminals“Company name”VTL10Local VTL Scripts

- Restart your Client Terminal or Right Click on “Local VTL Scripts” Tree Node to find the script.

Additional information

| Plugin-Type | Client VTL – Custom Indicator |

|---|---|

| Compatibility |