$0.00

In stock

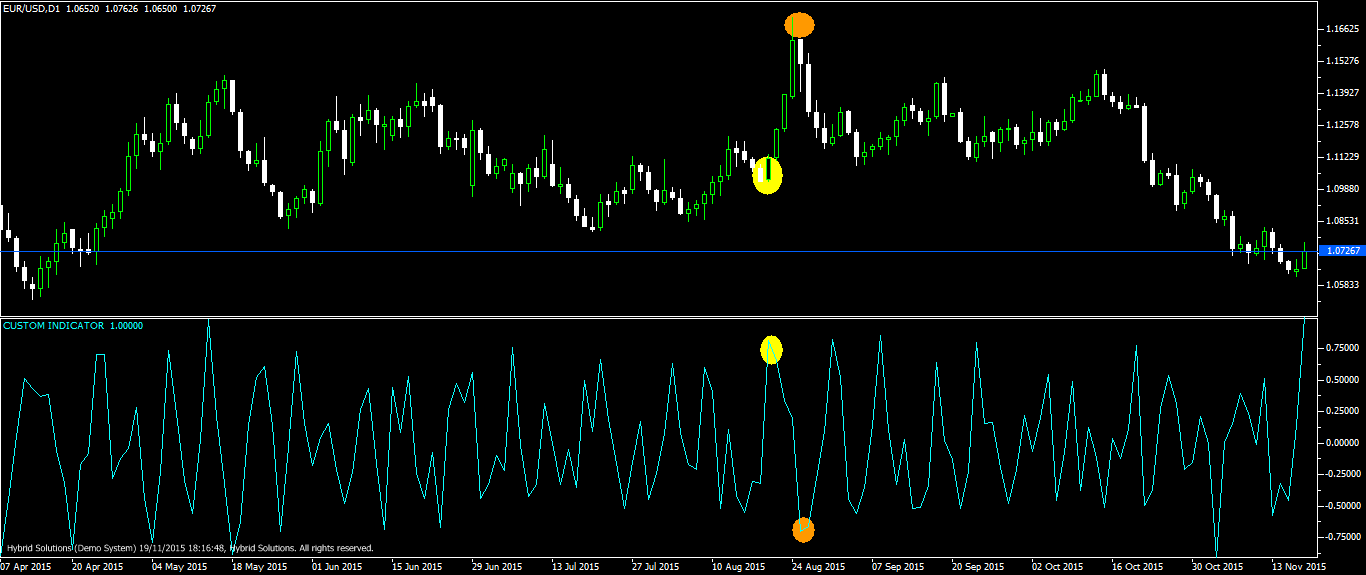

Correlation ratio (corr indicator) measures the most recent price movement against price movement in the same period in the historical data.It compares price move in last few price bars defined by the parameter “corrLen” against the historical data and plots the correlation ratio.

(Downloads - 1815)

Correlation ratio (corr indicator) measures the most recent price movement against price movement in the same period in the historical data.It compares price move in last few price bars defined by the parameter “corrLen” against the historical data and plots the correlation ratio.

Correlation ratio values falls within the range zero to one. Extreme values in the correlation ratio indicates significant deviation from usual price moves in the asset. It is a statistical measure, not a technical indicator. However in trading, when correlation ratio reaches an extreme level, price reversal or consolidation is anticipated.

Deviations from normal price behavior indicates an overbought or oversold market condition. Thus it can be used for counter trend trading and profit booking. It works well in conjunction with other technical indicators.

Usage

- Download the attachment from vStore or directly from the vStore tab in your terminal by performing a right click on it and selecting Download & Install

- Copy it to your company VertexFX Local VTL Files folder i.e. C:Program FilesCompany Namevtl10Local VTL Files

- Restart your Client Terminal or Right Click on “Local VTL Scripts” Tree Node to find the script.

Additional information

| Plugin-Type | Client VTL – Custom Indicator |

|---|---|

| Compatibility |