$0.00

In stock

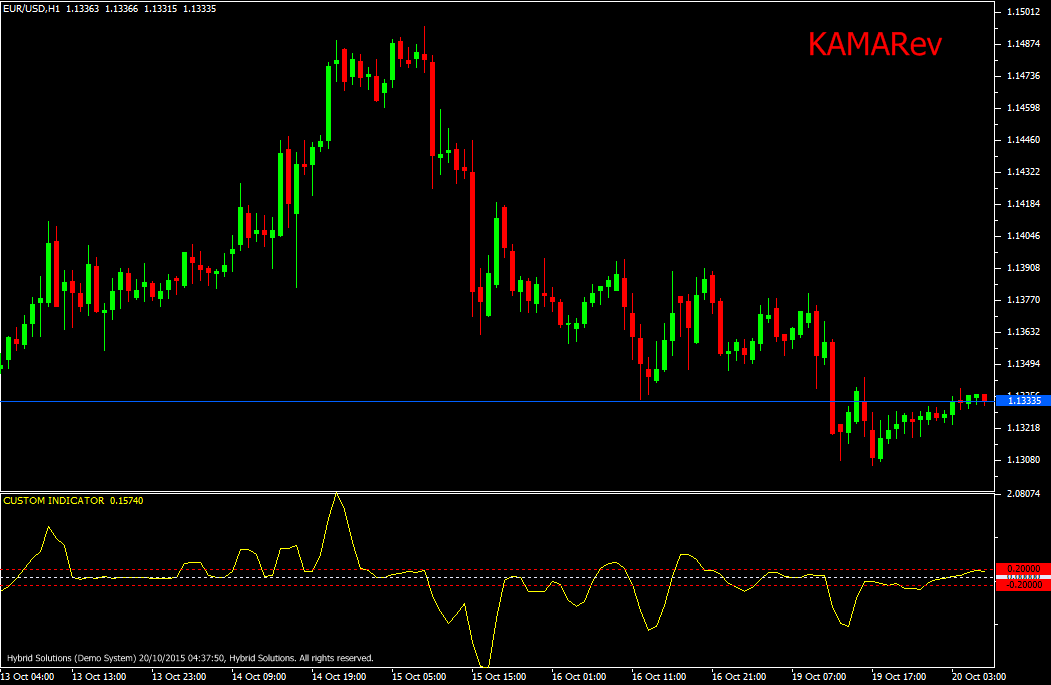

KAMA Reversal (Kaufman’s Adaptive Moving Average) indicator is unique VertexFX client side VTL indicator to detect market phases based on change in price and volatility.

It is based on the family of adaptive moving averages. In adaptive moving averages, the moving average period is calculated dynamically (instead of fixed period). This gives an advantage of the indicator responding faster and differently to different market circumstances.

(Downloads - 1518)

KAMA Reversal (Kaufman’s Adaptive Moving Average) indicator is unique VertexFX client side VTL indicator to detect market phases based on change in price and volatility.

It is based on the family of adaptive moving averages. In adaptive moving averages, the moving average period is calculated dynamically (instead of fixed period). This gives an advantage of the indicator responding faster and differently to different market circumstances. To calculate KAMA Reversal, we first calculate the change between the current price and price KAMA_PERIOD bars ago. The sum of absolute change in prices over the KAMA_PERIOD is also calculated, which is termed as cumulative volatility. Using Kaufman’s smoothing co-efficients, we smooth the cumulative volatility and derive the KAMA Reversal indicator.

This indicator employs the concept of volatility. When the price saturates, the volatility is low, and a precursor to change in trend direction or a huge price movement. Similarly, when the volatility is high, price must soon reach saturation and lead to lower volatility. Prices alternately pass through phases of high and low volatility. The KAMA indicator captures this transition from higher volatility to lower volatility and the change in direction. The KAMA is an unbounded oscillator based on the zero line. It follows the market trends with minimal lag. When there is a clear upward trend, KAMA moves upwards, and when there is a clear downward trend it moves downwards. In sideways markets, KAMA either fluctuates around the zero line, or if it was in a trend, then it starts reversing the direction.

BUY – Place Buy position when KAMA Reversal has bottomed out below zero and has started rising for at least two candles.

SELL – Place Sell position when KAMA Reversal has topped out above zero and has started falling for at least two candles.

Usage

- Download the attachment from vStore or directly from the vStore tab in your terminal by performing a right click on it and selecting Download & Install

- Copy it to your company VertexFX Local VTL Files folder i.e. C:Program FilesCompany Namevtl10Local VTL Files

- Restart your Client Terminal or Right Click on “Local VTL Scripts” Tree Node to find the script.

Additional information

| Plugin-Type | Client VTL – Custom Indicator |

|---|---|

| Compatibility |