$0.00

In stock

Adaptive Cyber Cycle Indicator is a VertexFX client side Indicator based on Cyber Cycle indicator to detect market cycles and turning points.

Due to the adaptive nature of the indicator, it detects the dominant cycle of market automatically and is therefore more responsive than the (static) Cyber Cycle.

(Downloads - 1476)

Adaptive Cyber Cycle Indicator is a VertexFX client side Indicator based on Cyber Cycle indicator to detect market cycles and turning points.

Due to the adaptive nature of the indicator, it detects the dominant cycle of market automatically and is therefore more responsive than the (static) Cyber Cycle.

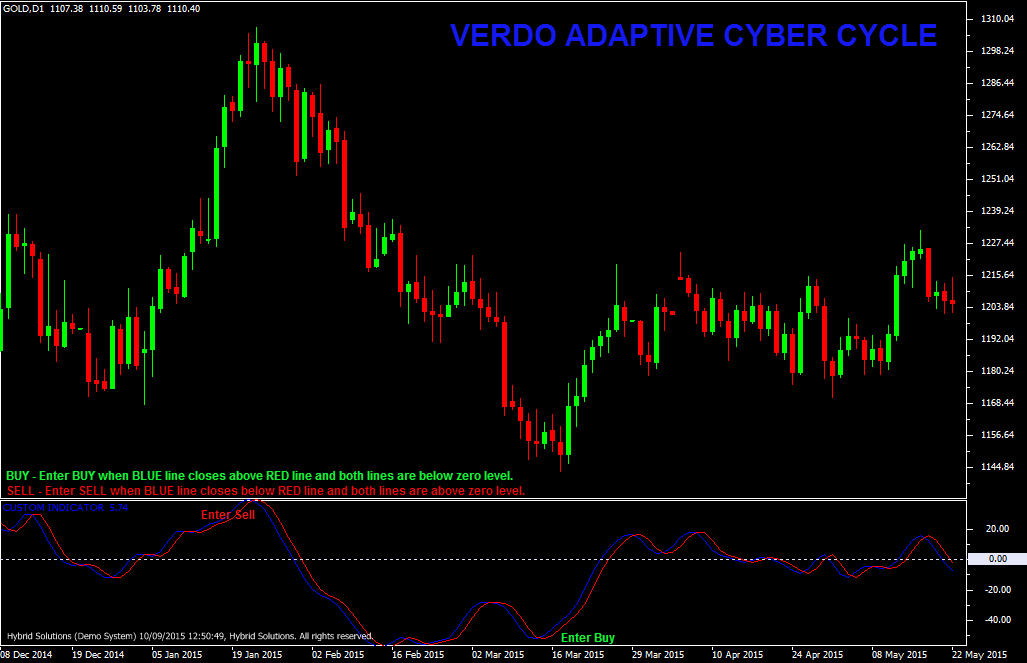

It comprises of two components, the Adaptive Cycle (Blue) signal and the Trigger (Red) signal. When the Cycle line crosses above the Trigger line, the market is at the bottom of the cycle. Similarly, when the Cycle line crosses below the Trigger line we are at the top of the cycle.

This indicator has a minimal lag of one to two bars. The median price is first smoothed over 3 bars using a Weighted Moving Average (WMA). Then this smoothed price further smoothed using Apha to calculate Cycle value. The Trigger value is calculated by delaying the Cycle value by 1 bar. It has a better response than Cyber Cycle from which it is derived because it automatically detects the dominant cycle of the market.

BUY – Place Buy position when Blue line closes above Red line and both lines are below zero level.

SELL – Place Sell position when Blue line closes below RED line and both lines are above zero level.

Usage

- Download the attachment.

- Copy it to your company VertexFX Local VTL Files folder i.e. C:Program FilesCompany Namevtl10Local VTL Scripts

- Restart your Client Terminal or Right Click on “Local VTL Scripts” Tree Node to find the script.

Additional information

| Plugin-Type | Client VTL – Custom Indicator |

|---|---|

| Compatibility |