$0.00

In stock

Adaptive RVI is a VertexFX Indicator to detect turn in market direction, as well as the starting and ending of market cycles. Adaptive RVI is based upon RVI indicator – by applying Adaptive smoothing to the RVI indicator.

(Downloads - 1416)

Adaptive RVI is a VertexFX Indicator to detect turn in market direction, as well as the starting and ending of market cycles. Adaptive RVI is based upon RVI indicator – by applying Adaptive smoothing to the RVI indicator.

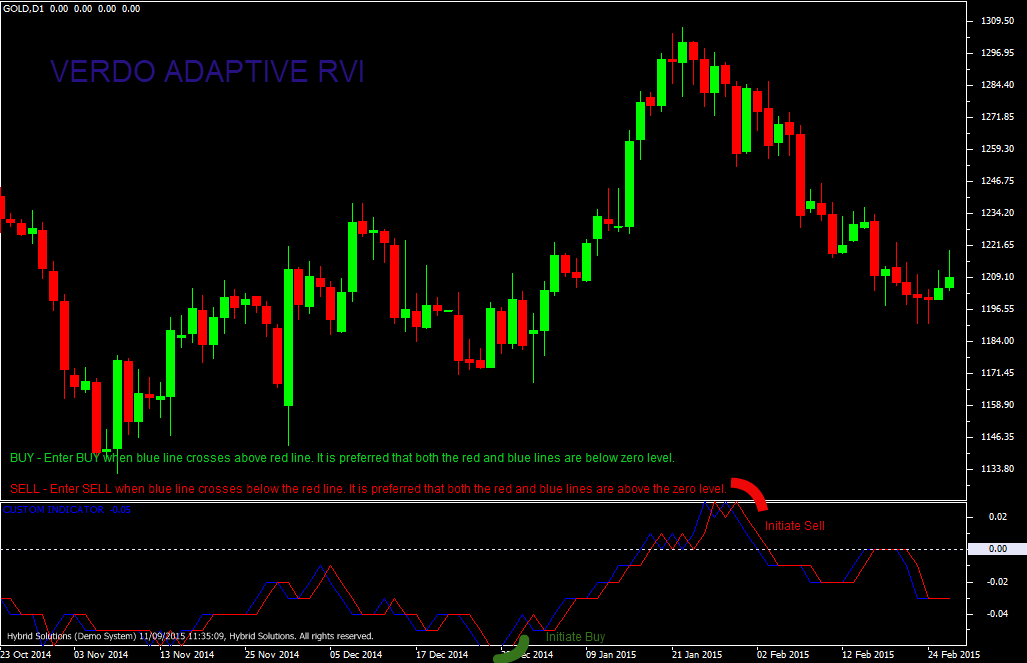

The basic idea of Verdo Adaptive RVI is that prices tend to close higher than they open in up markets and tend to close lower than they open in down markets. The vigor of the move is thus established by where the prices reside at the end of the candle. To normalize the index to the trading range, the change in price is divided by the maximum range of prices for the candle.

Unlike RVI, which uses fixed period input, here we calculate the cycle period based upon the median price and cycle phase. This eliminates using a fixed period and hence makes the RVI adaptive. In the next phase, we smooth it using the smoothing Alpha. The Adaptive RVI consists of two components, the main RVI signal (Blue) and the secondary trigger (Red). The trigger line is the adaptive RVI delayed by one bar to detect crossovers.

BUY – Place Buy position when blue line crosses above red line. It is preferred that both the red and blue lines are below zero level.

SELL – Place Sell when blue line crosses below the red line. It is preferred that both the red and blue lines are above the zero level.

Usage

- Download the attachment.

- Copy it to your company VertexFX Local VTL Files folder i.e. C:Program FilesCompany Namevtl10Local VTL Scripts

- Restart your Client Terminal or Right Click on “Local VTL Scripts” Tree Node to find the script.

Additional information

| Plugin-Type | Client VTL – Custom Indicator |

|---|---|

| Compatibility |