$0.00

In stock

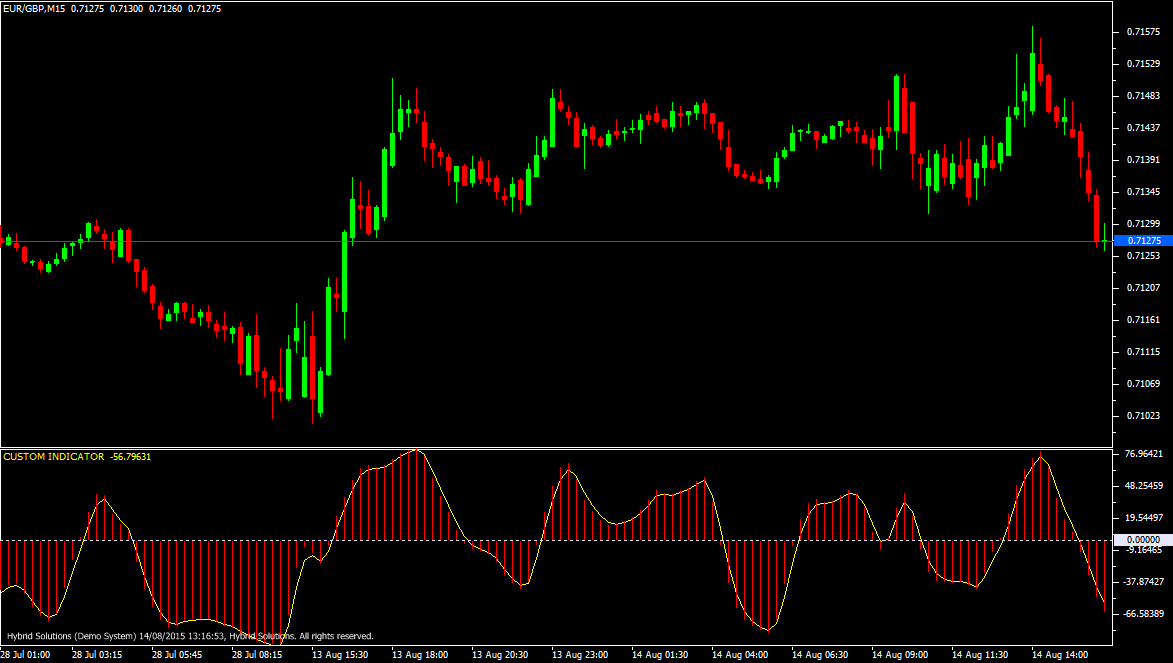

Ergodic indicator is a VertexFX indicator used in cycle market trading. It is based on typical price difference between current price and previous candle bars (old candles), which is smoothed twice. It comprises of two components, the main indicator (Red histogram) and the signal indicator (Yellow) which is the Smooth period EMA of the main indicator. Ergodic calculates the difference in current price and previous candle bars (old candles).

(Downloads - 1500)

Ergodic indicator is a VertexFX indicator used in cycle market trading. It is based on typical price difference between current price and previous candle bars (old candles), which is smoothed twice. It comprises of two components, the main indicator (Red histogram) and the signal indicator (Yellow) which is the Smooth period EMA of the main indicator. Ergodic calculates the difference in current price and previous candle bars (old candles).

Similarly, the absolute difference between the two is also calculated. This value is smoothed twice using S period EMA and then U period EMA, and the ratio of the two is calculated. This is the main (Red histogram) signal. Afterwards, this main signal is smoothed using SMOOTH period EMA. The concept behind this indicator is that changes in prices are captured and smoothed. In trending markets, the change in price is continuously increasing (since the market is trending). When this change reaches a peak, the market reaches the end of the trend cycle.

BUY – Place Buy positions when both Red and Yellow lines reaches negative extreme values and started to rise gradually.

SELL – Place Sell position when both Red and Yellow lines reaches positive extreme values and started to fall gradually.

Usage

- Download the attachment.

- Copy it to your company VertexFX Local VTL Files folder i.e. C:Program FilesCompany Namevtl10Local VTL Scripts

- Restart your Client Terminal or Right Click on “Local VTL Scripts” Tree Node to find the script.

Additional information

| Plugin-Type | Client VTL – Custom Indicator |

|---|---|

| Compatibility |