$0.00

In stock

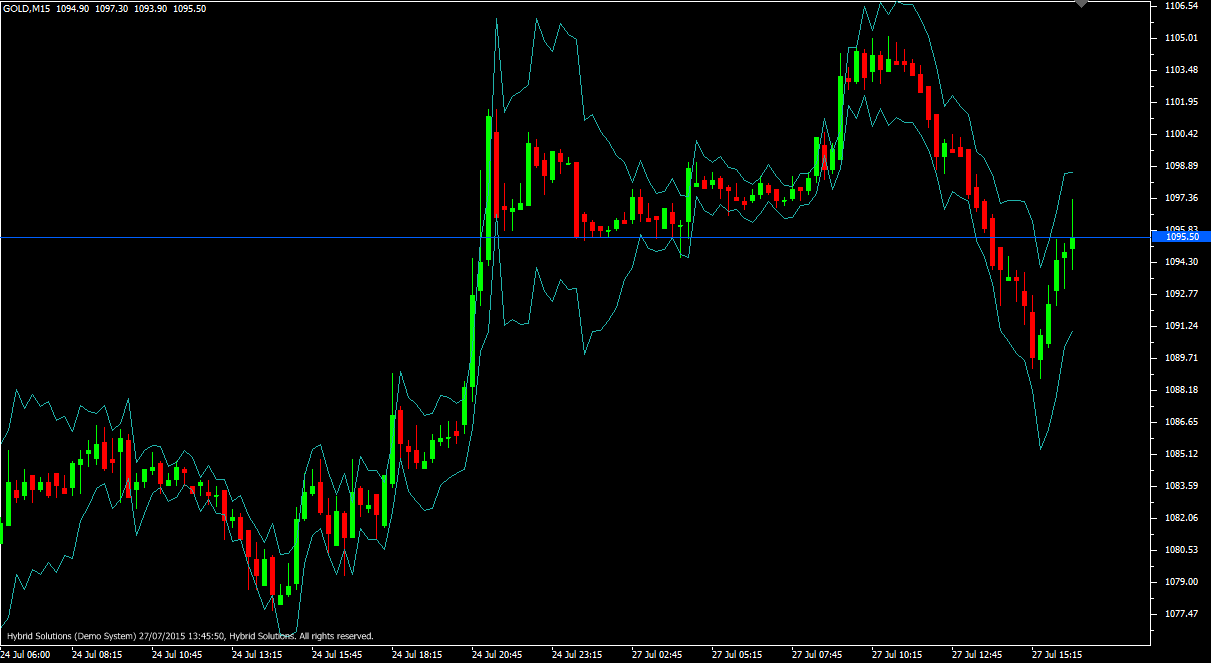

The Standard Deviation Band is a VertexFX Indicator which is used to determine the trading range of any instrument, and also helpful in verifying whether the instrument follows normal distribution.

(Downloads - 1434)

The Standard Deviation Band is a VertexFX Indicator which is used to determine the trading range of any instrument, and also helpful in verifying whether the instrument follows normal distribution.

If an instrument’s price follows normal distribution pattern then 68% of the bars will be enclosed within the upper and lower bands (2 sigma deviations). So, the upper and lower bands are considered the normal trading range. Stop-loss can be set beyond this trading range. This indicator first calculates the standard deviation for the selected instrument based upon the underlying price field (e.g. Close, High, Low, Median, and Typical – configurable) over the specified period (configurable). The upper band is calculated by multiplying the standard deviation with the multiplier and adding it to the current price. Likewise, the lower band is calculated by multiplying the standard deviation with the multiplier and subtracting it from the current price.

Buy: You may place a Buy position when the price crosses the upper band from below, use the lower band as a trailing stop loss. Close Buy position when price crosses below lower band.

Sell: You may place a Sell position when the price crosses the lower band from above, use the upper band as a trailing stop loss. Close the Sell position when the prices are above the upper band.

Usage

- Download the attachment.

- Copy it to your company VertexFX Local VTL Files folder i.e. C:Program FilesCompany Namevtl10Local VTL Scripts

- Restart your Client Terminal or Right Click on “Local VTL Scripts” Tree Node to find the script.

Additional information

| Plugin-Type | Client VTL – Custom Indicator |

|---|---|

| Compatibility |