$0.00

In stock

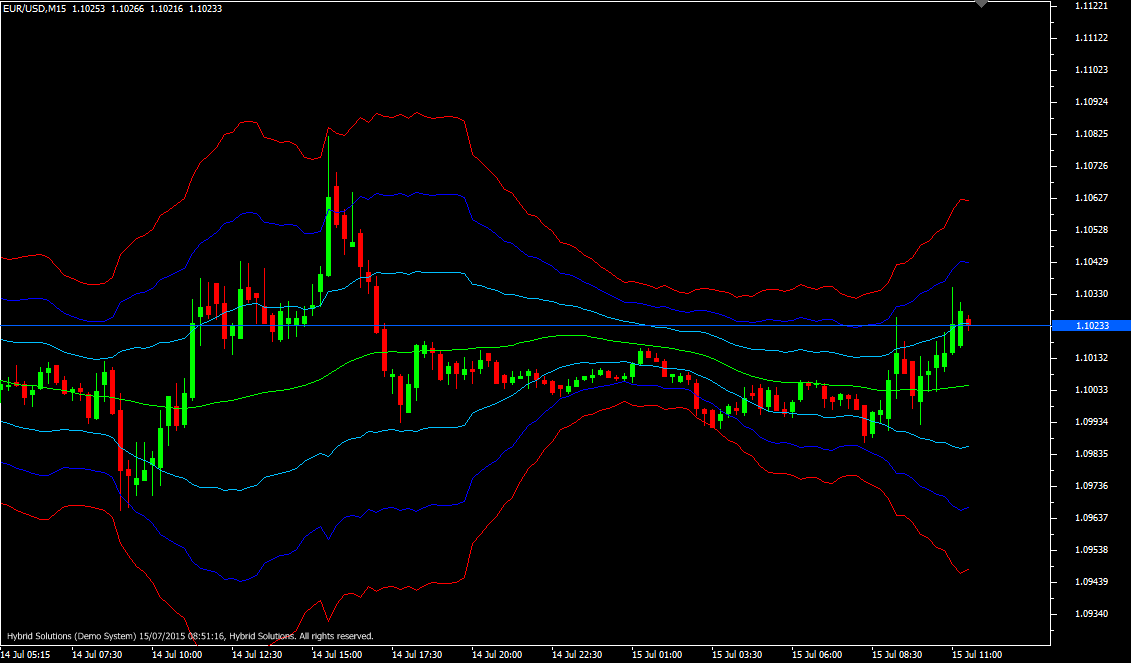

The ATR is a VertexFX local script which measures the volatility – fluctuations in price. Greater the fluctuations in price, greater is the value of ATR. ATR Channels consist of three upper bands and three lower bands with the Moving Average in the center.

(Downloads - 1535)

The ATR is a VertexFX Indicator which measures the volatility – fluctuations in price. Greater the fluctuations in price, greater is the value of ATR. ATR Channels consist of three upper bands and three lower bands with the Moving Average in the center.

The ATR channels cannot predict direction of the move, but are very useful in determining breakouts.When the ATR bands are narrow, the markets exhibit low volatility and there is a high probablity of a breakout on either (BUY or SELL) side.ATR channels are useful for calculating stop-loss levels and position sizing.

When entry price from ATR channels is farther, it means that instrument exhibits high volatility, and therefore the trade size can be reduced. Traders also typically place stop-losses (trailing) stops close to the ATR bands – typically below the lower ATR band for LONG trades, and above the upper ATR band for short trades.

User Inputs :

a) ATR_PERIOD – The period for calculating the ATR.

b) MA_PERIOD – The period for calculating the MA (center line).

c) ATR_MULT_1 – The multiplier applied to the ATR to display the first band (Sky Blue)

d) ATR_MULT_2 – The multiplier applied to the ATR to display the second band (Red)

e) ATR_MULT_3 – The multiplier applied to the ATR to display the third band (Blue)

Unlike other indicators, this indicator provides flexibility of allowing different input settings for the ATR Period and the center MA period.

Usage

- Download the attachment.

- Copy it to your company VertexFX Local VTL Files folder i.e. C:Program FilesCompany Namevtl10Local VTL Scripts

- Restart your Client Terminal or Right Click on “Local VTL Scripts” Tree Node to find the script.

Additional information

| Plugin-Type | Client VTL – Custom Indicator |

|---|---|

| Compatibility |