$0.00

Developed By:

NeeduVerdeSolution

In stock

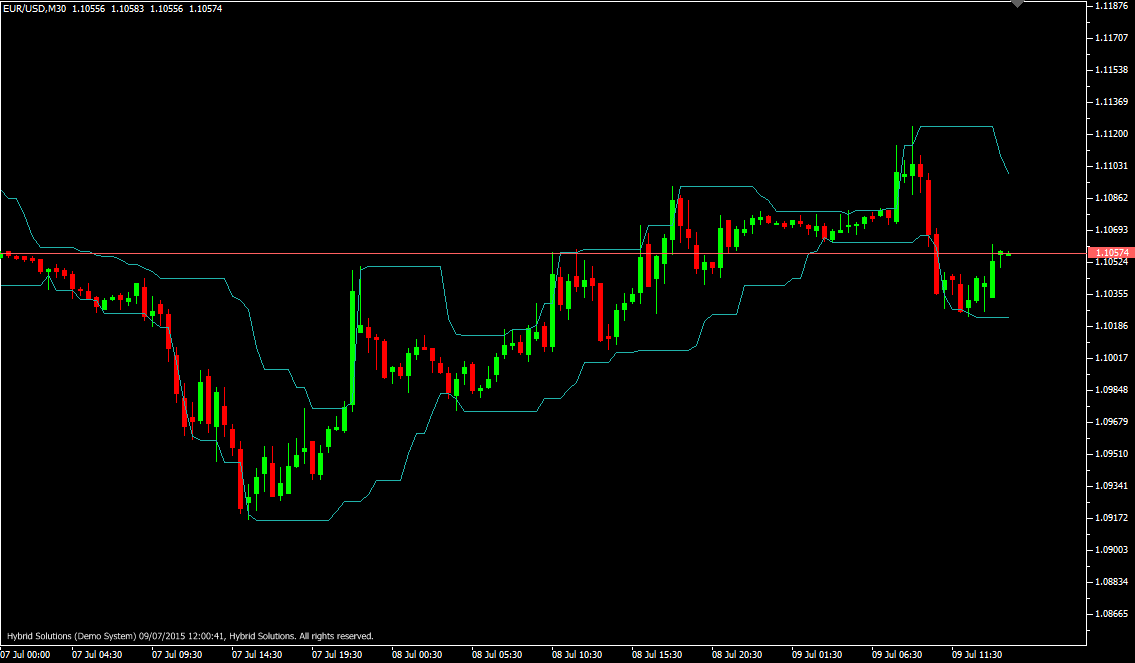

The Donchian Channel is a client side VTL Script comprised of an upper channel and a lower channel. The upper channel is calculated by finding the highest high of the last N periods (from the previous bar). The lower channel is calculated by finding the lowest low of the last N periods (from the previousbar).

(Downloads - 1469)

SKU:

527

Categories: Free, VTL Plugins

The Donchian Channel is a client side VTL Script comprised of an upper channel and a lower channel. The upper channel is calculated by finding the highest high of the last N periods (from the previous bar). The lower channel is calculated by finding the lowest low of the last N periods (from the previousbar).

It is useful in investigating the volatility of an instrument. If the Donchian Channels are narrow, it implies that the trading range is small and hence the instrument is not volatile.On the contrary, if the Donchian Channels are wide, it implies that the trading range is large and the instrument exhibits a lot of volatility.

The market cycles between periods of low volatility and high volatility, so the Donchian Channels are helpful to determine the current phase of the market. It can also be used to trade breakouts – when the Donchian Channels are narrow. Traders can enter breakout trades when the price moves out the Donchian channels by confirming the trend with other trend based indicators.

Usage

- Download the attachment.

- Copy it to your company VertexFX Local VTL Files folder i.e. C:Program FilesCompany Namevtl10Local VTL Scripts

- Restart your Client Terminal or Right Click on “Local VTL Scripts” Tree Node to find the script.

Additional information

| Plugin-Type | Client VTL – Custom Indicator |

|---|---|

| Compatibility |